In today’s fast-paced world, it’s easy to neglect your health through sleep deprivation, unhealthy diets, inactivity, and excessive gadget use. But it’s never too late to take charge. Healthcare products, such as Health Maintenance Organization (HMO) and life insurance, offered by Maxicare Healthcare Corporation and MaxiLife, respectively, can help.

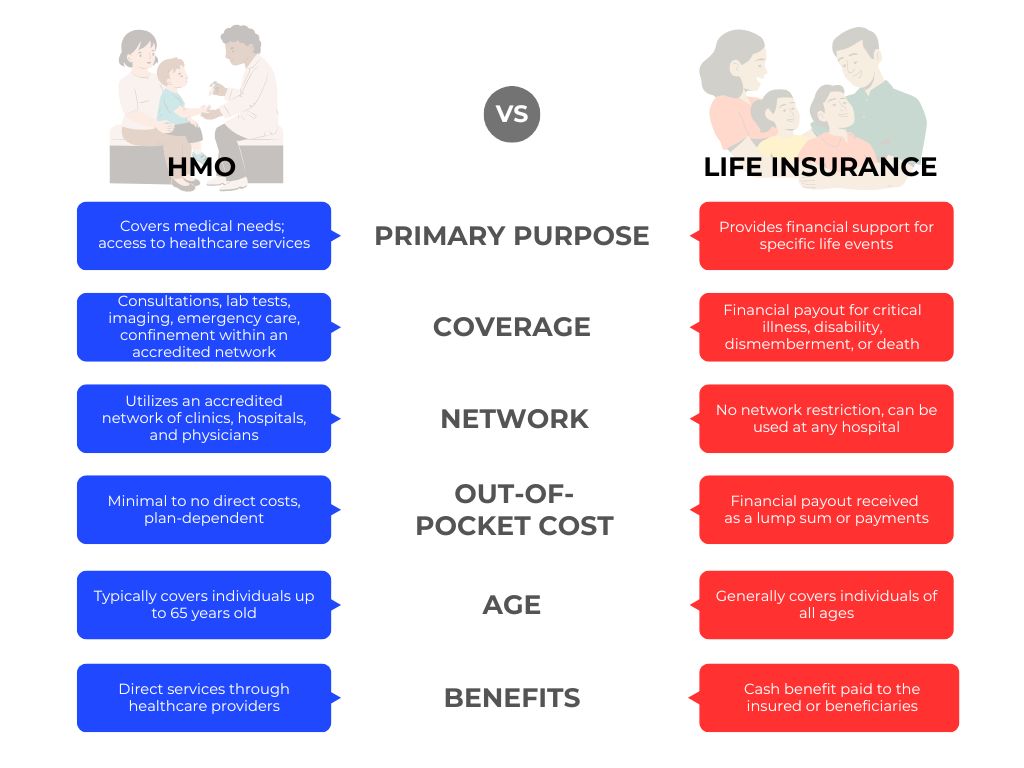

Now the question is: what’s the difference between an HMO and life insurance?

HMO and Life Insurance Explained

While both provide crucial protection, HMOs and life insurance serve distinct purposes. Below is a glance at their key differences:

In every stage of your life, Maxicare, MaxiHealth, and MaxiLife together offer products that provide holistic protection for you and your loved ones. With their combined offerings, you can have comprehensive healthcare, have peace of mind even in critical moments, and have financial security, all with confidence and ease.

As the country’s leading HMO, Maxicare offers HMO options that will suit your various needs. There’s MyMaxicare, the standard comprehensive HMO that includes inpatient and outpatient coverage as well as confinement and emergency cases, which may be applied by an individual or for the whole family. If being prepared for emergencies or uncertain situations is your concern, then there’s also LifesavER, a prepaid emergency card suitable for emergency medical attention.

Meanwhile, MaxiHealth, which also manages the operations of the Maxicare Primary Care Clinics, developed a prepaid healthcare option that addresses the specific healthcare needs of Filipinos. The new PRIMA is a prepaid healthcare card that comes in different variations, which are for preventive healthcare needs such as consultations and diagnostic services.

On the other hand, MaxiLife, a life insurance company, offers various options, such as providing financial support* primarily in the event of the insured’s death. It also covers* the insured in the event of a critical illness, accident, or disability, depending on the coverage.

-

TriShield 9 Health: Individual plan (9-year coverage, 3-year pay). Provides financial support to beneficiaries in the event of the insured’s death or diagnosis of any of 42 critical illnesses. Also includes benefits for accidental death, disablement, and dismemberment, as well as a daily hospital cash benefit.

-

TriShield 9 Life: Individual plan (9-year coverage, 3-year pay). Provides financial support to the beneficiaries in the event of the death or accidental death of the insured. Includes waiver of premiums for total and permanent disability.

-

HealthEase: Annual renewable critical illness term plan. Provides financial support to beneficiaries upon the insured’s death or diagnosis of 5 critical illnesses.

*Kindly note that benefits or coverage provided to the beneficiaries or the insured are subject to review based on the policy’s terms and conditions.

Life is full of surprises—but with Maxicare and MaxiLife, you can face each day with confidence. Because when you’re cared for and protected, you’re free to live your best life and live life to the max.

For HMO options, visit https://www.maxicare.com.ph/maxicare-plans.

Learn more about MaxiLife’s life insurance options by visiting https://shop.maxilife.com.ph/pages/products.

For the prepaid healthcare products, visit https://www.maxihealth.com.ph/products/.